Lambton Custom Flooring

Strategic Analysis & Growth Strategy

Project Overview

Lambton Custom Flooring (LCF) is a family run flooring retailer and installer based in Sarnia, Ontario. Following a period of declining profitability despite rising revenue, the business faced a strategic crossroads. Rising operating costs, shifting customer demand, and increasing competition forced leadership to reconsider how the company should grow and stabilize long-term profitability.

This case study analyzes LCF’s financial performance, market position, and growth options to recommend a realistic, data driven strategy for recovery and expansion.

Project Scope

Strategic Analysis

Growth Strategy

Financial Evaluation

Applications & Tools

Adobe InDesign

Adobe Illustrator

Duration

Start – September 2025

End – October 2025

Analyzing The Business

Objective

Evaluating and recommending a growth strategy that restores profitability while protecting LCF’s reputation and operational stability.

Business Problem

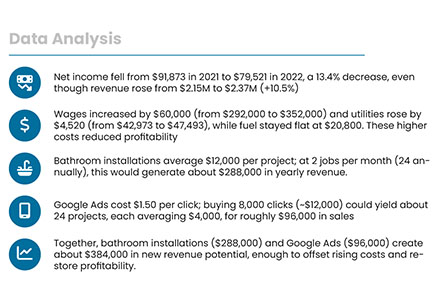

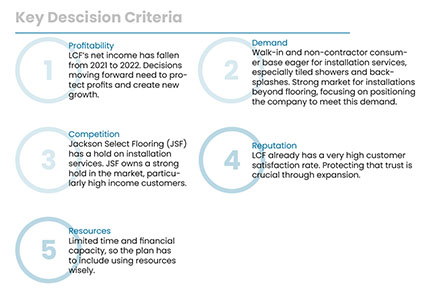

Between 2021 and 2022, LCF experienced a 13.4% decline in net income, even as revenue increased by over 10%. Rising labour and utility costs compressed margins, and customer hesitation around large renovation projects added further pressure.

The core challenge was determining how LCF could reverse declining profits while managing risk, limited resources, and an uncertain economic environment. Leadership needed to decide whether to invest in new services, expand marketing efforts, enter a new geographic market, or restructure ownership.

Context & Constraints

Several constraints shaped the decision environment:

-

Cost pressure: Significant increases in wages and utilities reduced profitability

-

Limited resources: Time, capital, and management capacity were constrained

-

Market dynamics: Strong customer demand for installation services, especially bathroom renovations

-

Competition: Established competitors with strong installation market share

-

Reputation risk: Any expansion needed to preserve LCF’s high customer satisfaction

These constraints required a strategy that balanced growth with operational discipline.

My Role

This project was completed as a team based business case study. I contributed to:

-

Financial analysis and interpretation of income and cost trends

-

Evaluating growth alternatives using quantitative and qualitative criteria

-

Developing and justifying the final strategic recommendation

-

Structuring the action plan and implementation roadmap

Approach & Business Thinking

Data Driven Diagnosis

The analysis began by separating revenue growth from profitability decline. Although sales increased, rising wages and utilities eroded margins, signaling that growth alone would not solve the problem. This reframed the challenge as a margin and efficiency issue, not purely a sales issue.

Evaluation Criteria

Three primary strategic alternatives were assessed using consistent decision criteria:

-

Profitability and revenue potential

-

Market demand and competitive positioning

-

Resource requirements and risk

-

Impact on brand reputation

This ensured that recommendations were grounded in both financial logic and operational feasibility.

Strategic Alternatives Considered

1

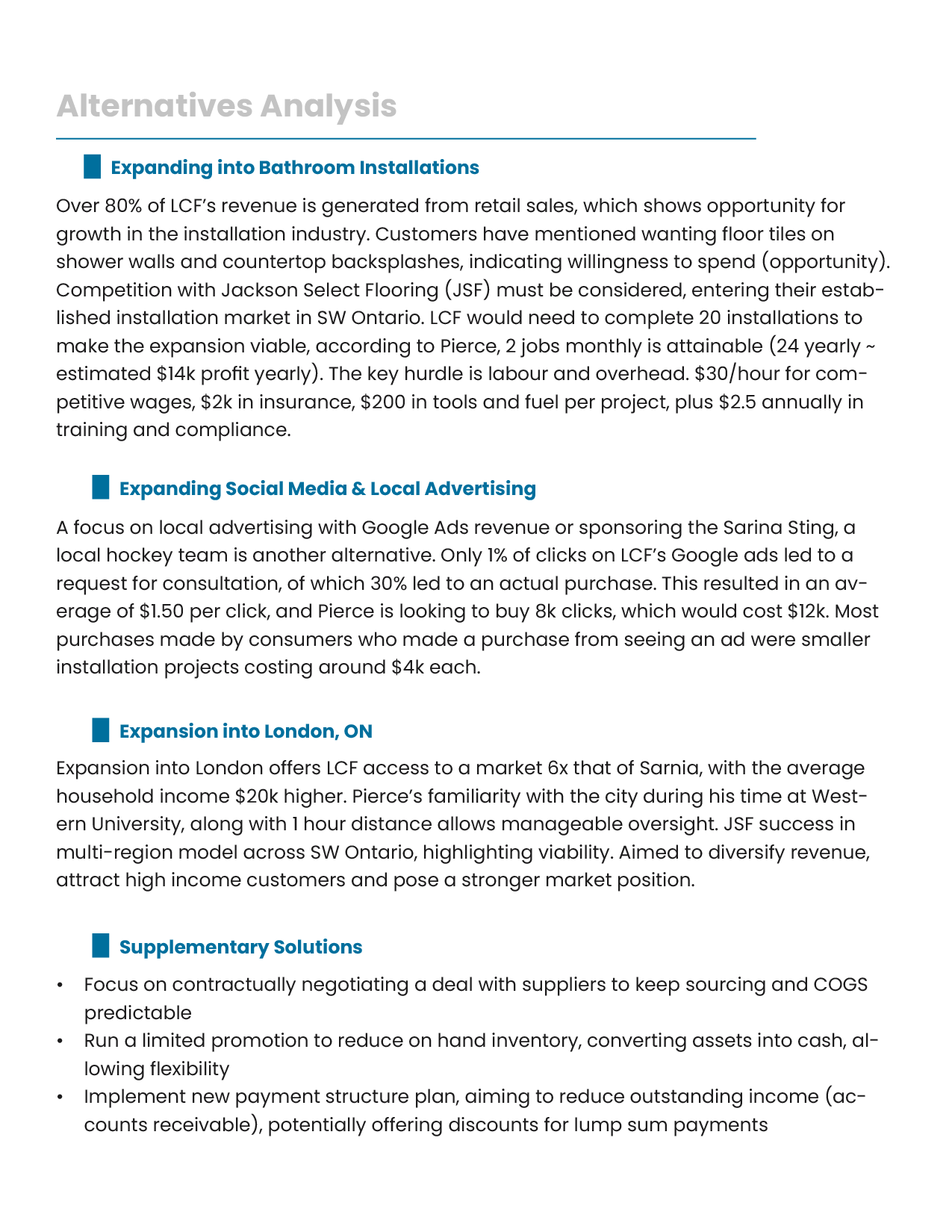

Expansion into Bathroom Installations

Customer inquiries revealed strong demand for custom bathroom installations, a higher-value service adjacent to LCF’s core capabilities. Financial projections showed that completing just two projects per month could generate approximately $288,000 in annual revenue, enough to meaningfully offset rising costs.

2

Increased Digital and Local Advertising

Expanding Google Ads and local sponsorships offered a lower-risk way to increase visibility. While individual projects generated through ads were smaller, they provided consistent cash flow and brand exposure.

3

Geographic Expansion to London, Ontario

Entering a larger, higher-income market presented long-term growth potential but required significant upfront investment and management oversight, increasing risk during an already uncertain period.

Recommendation & Rationale

The recommended strategy was a combined approach:

-

Expand into bathroom installations to capture high-value demand

-

Increase targeted digital and local advertising to drive consistent lead flow

This approach balanced short-term profitability with long-term brand growth while staying within LCF’s operational limits. It leveraged existing strengths, minimized risk, and avoided overextending resources.

Action Plan

The recommendation was supported by a clear execution roadmap:

This phased plan ensured accountability and adaptability.

Outcome

This case study demonstrated how strong revenue figures can mask underlying profitability issues, and how disciplined analysis is required to identify the real drivers of business performance. It reinforced the importance of balancing ambition with feasibility, especially in small and medium-sized businesses.

The project strengthened my ability to evaluate tradeoffs, work with financial data, and recommend strategies that align growth with operational reality.